🟥 Cover / Featured

Editor's Note →

🟪 Health, Environment & Society

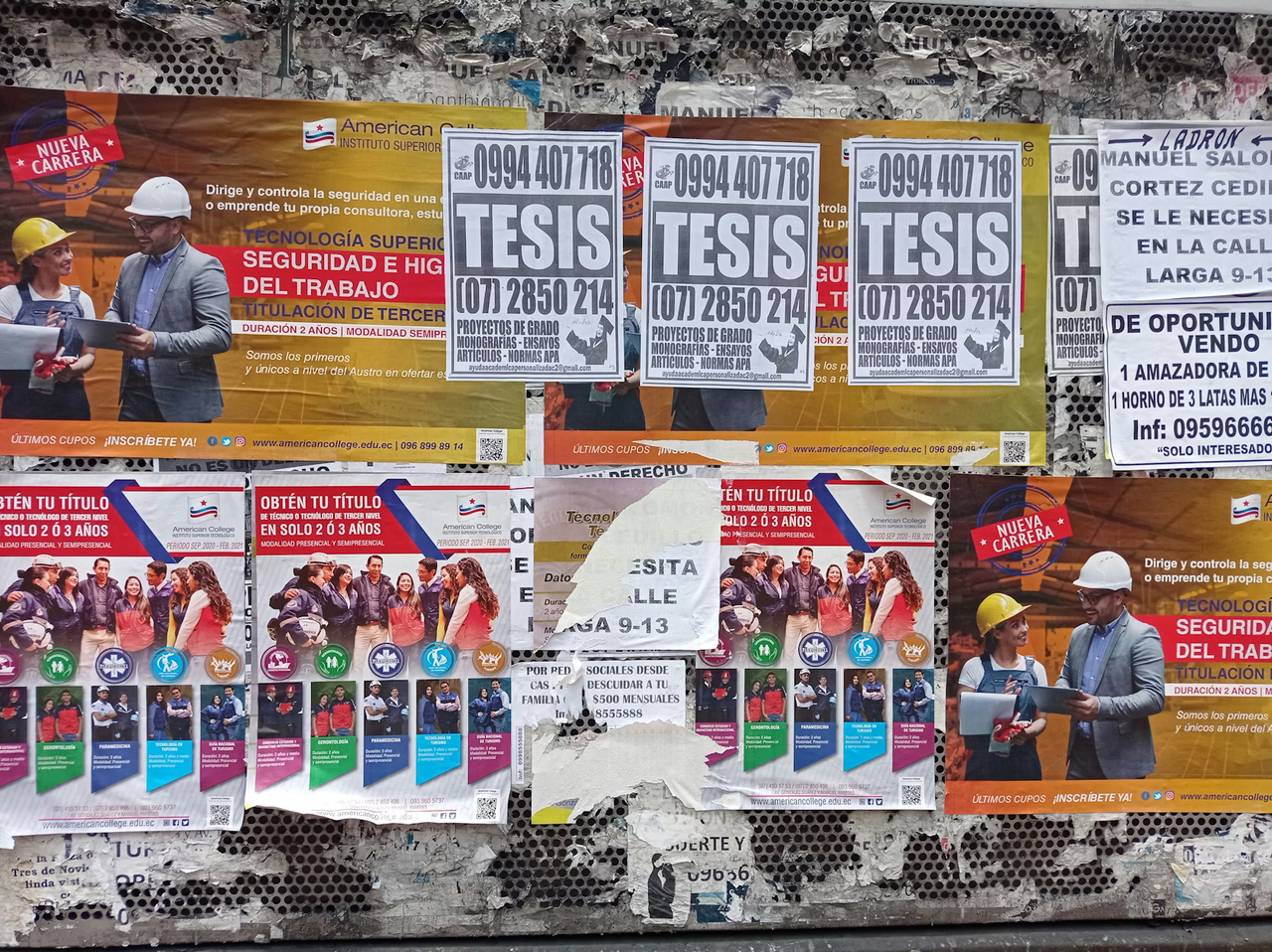

🟥 Dispatches / Investigative Analysis

🟥 System Intelligence Modules

Tin Tuna Index

This tool turns money into time. It shows how many minutes of work buy one can of protein. Use the same currency for wage and price. The currency fills by country.

UN46 Country Dossiers

These sheets cover the least developed states. Each sheet blends politics budgets people and exposure into one view. All reports below are live.

| Flag | Country | Dossier | Status |

|---|

We use official flag links. The format is https://flagcdn.com/w640/xx.png

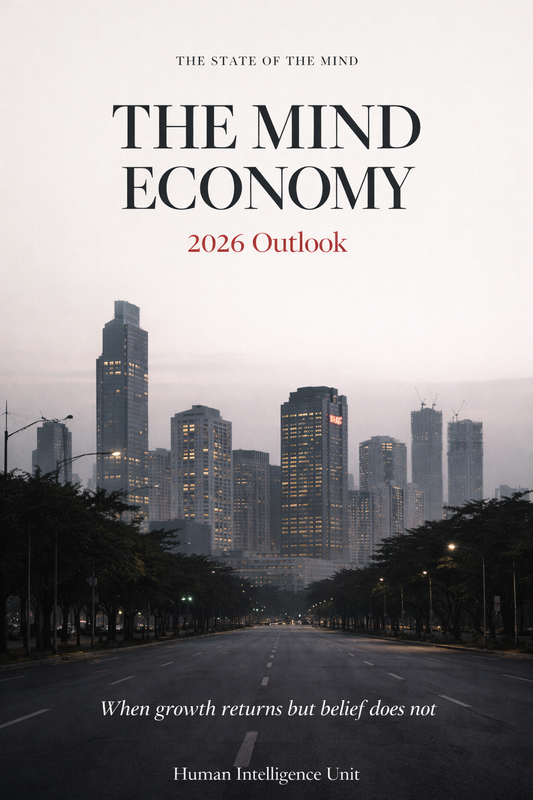

🧠 Mind Economy Index (MEI) — 2026

The Mind Economy Index measures how effectively countries convert growth into belief, stability, opportunity, and social confidence. It deliberately goes beyond GDP.

| Country | Region | GDP Growth |

Inflation | Youth Unemp. |

Education Spend |

Health Spend |

Institutional Trust |

Migration Pressure |

Governance Strain |

MEI Score |

|---|---|---|---|---|---|---|---|---|---|---|

| India | Asia | 6.5% | 5.4% | 23% | 4.1% | 3.0% | Medium | Moderate | Medium | 62 |

| China | Asia | 4.1% | 1.2% | 21% | 4.0% | 5.6% | Low | Low | Medium | 58 |

| Pakistan | South Asia | 2.0% | 28.0% | 31% | 2.0% | 3.2% | Low | High | High | 37 |

| Bangladesh | South Asia | 5.8% | 9.9% | 26% | 2.5% | 2.9% | Medium | Moderate | Medium | 54 |

| United States | Advanced | 2.1% | 3.4% | 9% | 5.0% | 8.3% | Low | Low | Medium | 55 |

| United Kingdom | Advanced | 0.8% | 4.2% | 14% | 5.6% | 9.8% | Low | Low | Medium | 53 |

| Russia | Eurasia | 3.2% | 7.5% | 15% | 3.8% | 5.3% | Low | Moderate | High | 49 |

| South Africa | Africa | 1.3% | 6.0% | 46% | 6.6% | 8.5% | Low | High | High | 44 |

| Nigeria | Africa | 3.0% | 24.0% | 42% | 1.7% | 3.0% | Low | High | High | 38 |

| Kenya | Africa | 5.2% | 7.1% | 35% | 5.1% | 4.6% | Medium | High | Medium | 50 |

| Ghana | Africa | 2.8% | 23.2% | 32% | 3.9% | 3.5% | Low | High | High | 41 |

| Egypt | North Africa | 3.6% | 30.0% | 25% | 3.2% | 4.5% | Low | High | High | 39 |

| Mali | Sahel | 4.8% | 9.2% | 38% | 2.8% | 3.6% | Low | High | Very High | 35 |

| Burkina Faso | Sahel | 3.5% | 8.6% | 41% | 3.0% | 3.8% | Low | High | Very High | 34 |

| Niger | Sahel | 4.9% | 7.4% | 45% | 2.6% | 3.2% | Low | Very High | Very High | 32 |

| Chad | Sahel | 3.8% | 6.1% | 43% | 2.4% | 3.1% | Low | Very High | Very High | 31 |

| Brazil | Latin America | 2.1% | 4.6% | 21% | 5.5% | 9.0% | Low | Moderate | Medium | 57 |

| Argentina | Latin America | -1.5% | 140% | 28% | 5.4% | 6.2% | Low | High | High | 36 |

| Colombia | Latin America | 1.2% | 7.3% | 22% | 4.5% | 5.9% | Medium | Moderate | Medium | 52 |

| Peru | Latin America | 2.4% | 4.0% | 24% | 4.2% | 5.3% | Medium | Moderate | Medium | 54 |

| Venezuela | Latin America | 3.0% | 190% | 35% | 2.0% | 3.5% | Very Low | Very High | Extreme | 28 |

Sources: IMF WEO, World Bank WDI, ILOSTAT, UN DESA, Afrobarometer, Edelman Trust Barometer, national statistics offices.

Index constructed by The State of the Mind — Human Intelligence Unit.

.jpg)